Coyyn.com banking – Invest Safely!

Managing your finances in a fast-moving digital world can feel overwhelming, but it doesn’t have to be.

Coyyn.com banking is a modern solution designed to simplify how you save, spend, and grow your money securely online. It offers intuitive tools and a user-friendly platform tailored for both individuals and small businesses.

Explore how Coyyn digital banking and its smart financial tools are reshaping the way people bank in today’s tech-driven economy.

Table of Contents

Explanatory Guide Of coyyn – Must Check!

What is coyyn.com banking serving online?

Coyyn.com banking offers a digital-first banking experience that includes online money transfers, virtual account management, savings tools, and investment options. It caters to tech-savvy users who prefer managing their finances through secure, real-time access on the web and mobile devices.

Purpose of coyyn.com banking

The main goal of Coyyn.com banking is to provide seamless and secure financial services without the need for physical branches. It aims to bridge the gap between traditional banking and the digital world, giving users full control over their finances anytime, anywhere.

Read Also: Success100x.com – Earn Your 2025 Goals!

Who Can have access to coyyn

Anyone with internet access and a valid government-issued ID can sign up for Coyyn.com banking. It is ideal for individuals, freelancers, and small business owners looking for flexible, digital-first financial solutions.

Who is the owner of coyyn.com banking

Coyyn.com banking is reportedly operated by a forward-thinking fintech company, but specific ownership details are limited online. The platform is known for its transparency and secure banking framework, which reflects the professionalism of its managing team.

Where is coyyn.com banking situated?

While Coyyn.com operates entirely online, its corporate or operational roots are believed to be based in a fintech-friendly region. The platform doesn’t rely on physical branches, making it accessible across multiple countries with digital infrastructure.

Is Coyyn.com Banking Safe and Legitimate?

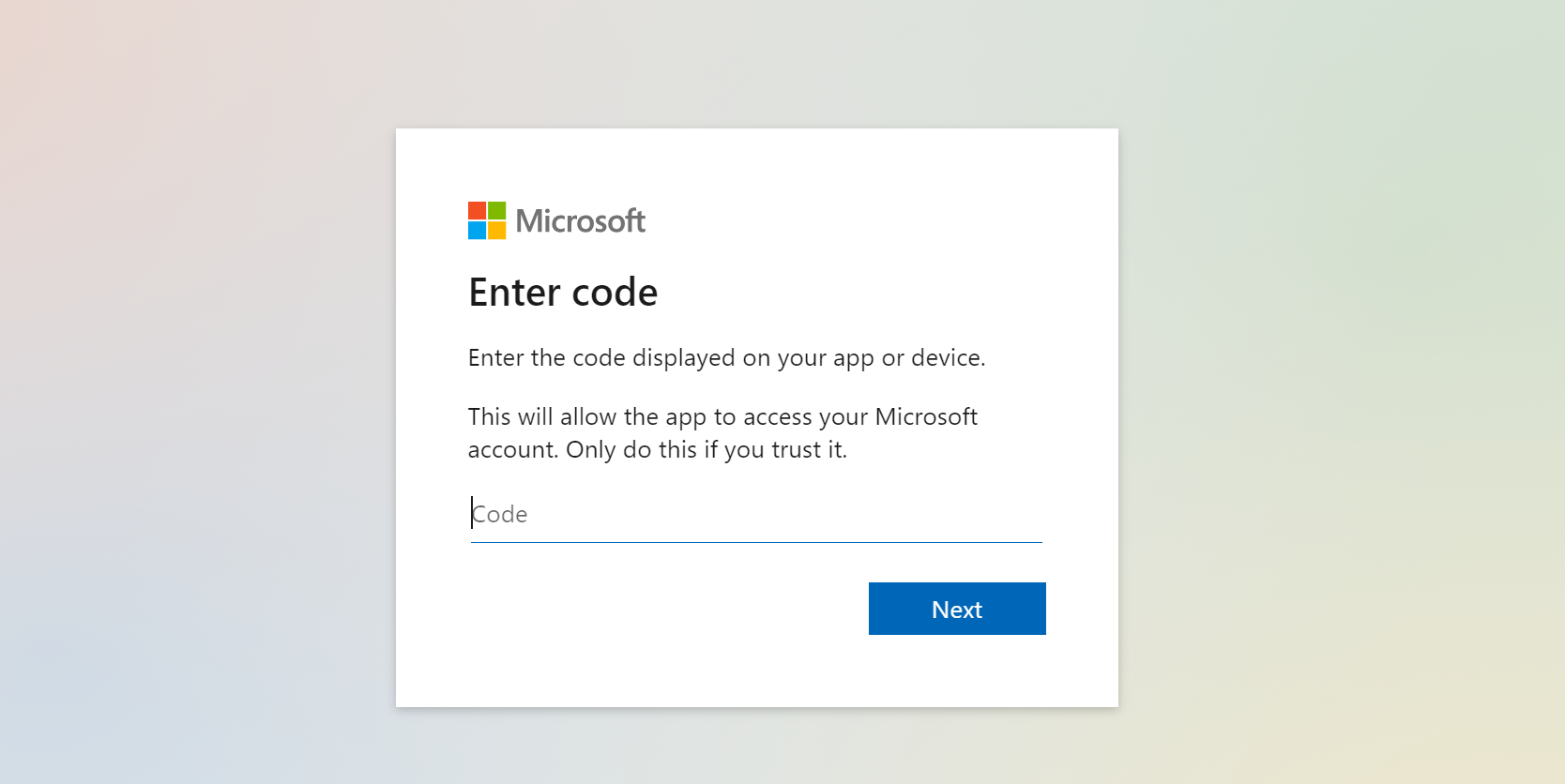

Coyyn.com operates with advanced security technologies like blockchain, encryption, and multi-factor authentication, designed to protect your financial data and transactions. The platform is compliant with international regulations and includes real-time fraud detection to safeguard users.

User reviews highlight its ease of use and reliability, noting fast global transfers and low fees—features often missing in traditional banks. Overall, Coyyn.com banking is considered trustworthy and worthy of use, especially for those seeking modern, secure digital finance.

Read Also: Https://onlypc.net – Trade Online!

How coyyn is skyrocketing behind the Scenes?

AI-Driven Experience and Support

Coyyn.com puts artificial intelligence to work in two key ways: AI chatbots are at the ready to answer your queries instantly, and smart algorithms analyze your spending habits. This creates personalized budgeting tips and tailored financial advice that adapts to your behaviour.

Advanced Security and Fraud Protection

Security is a top priority—end-to-end encryption ensures your data stays private, while two-factor authentication adds a strong layer of protection. Plus, AI-powered fraud detection watches your account in real time, flagging unusual activity instantly to keep your finances safe .

Smart Transaction Speed and Cost Efficiency

Coyyn.com handles financial transactions almost instantly using blockchain and smart contract technology, cutting down both processing time and fees. Whether you’re sending money internationally, setting up automated bill payments, or working with multiple currencies, the platform ensures your money moves fast and affordably.

Is There Any Refund Policy for Coyyn.com Banking?

Coyyn.com includes a documented Refund Policy as part of its support structure, showing a commitment to transparent user service.

Customers can submit refund requests through official customer support channels, providing transaction details and supporting documents. Most cases are reviewed and resolved within a 7–14 business day window.

To avoid delays, make sure to double-check billing records before payment and keep receipts handy—this helps ensure a smooth refund experience if needed.

How’s the staff of coyyn.com banking?

Coyyn.com is powered by a team of experienced professionals in finance, technology, and digital entrepreneurship. Their mission is to bridge the gap between traditional banking and the modern gig economy, offering innovative tools and practical guidance. With backgrounds in blockchain, fintech, and business development, the team designs Coyyn.com to be both user-friendly and forward-thinking. This blend of tech expertise and real-world finance experience enables them to create a digital banking platform that truly understands users’ needs.

Outstanding Key features of coyyn.com banking

Secure Digital Wallet

Coyyn offers a secure digital wallet that allows users to send, receive, and manage money easily. It’s designed with strong encryption to keep your finances safe.

Integrated Financial Tools

The platform includes built-in tools for budgeting, tracking expenses, and setting financial goals. These features help users manage their money wisely in one place.

User-Friendly Interface

Coyyn’s interface is simple, clean, and accessible—even for users new to digital banking. Navigation is smooth, and all functions are easy to find.

Fast Transactions

With Coyyn, transfers and payments happen quickly. The system supports instant transactions, which is perfect for freelancers and digital entrepreneurs.

Support for Online Workers

Coyyn is tailored to freelancers, creators, and online workers. It understands the challenges of non-traditional income and offers flexible tools to match that lifestyle.

Frequently Asked Questions:

Can coyyn.com be connected to other financial apps?

Yes, coyyn.com supports integration with some third-party budgeting and payment apps. This helps users track their finances across platforms and improves overall money management.

Does coyyn.com offer business banking services?

While coyyn.com mainly focuses on personal and freelance banking, it also offers basic tools useful for small businesses, such as invoicing, transaction tracking, and tax-friendly reporting.

Is there a mobile app for coyyn.com banking?

Yes, coyyn.com provides a mobile-friendly version and is currently developing a full-feature mobile app to enhance on-the-go access and quick financial actions.

Can I open multiple accounts on coyyn.com?

Currently, coyyn.com allows only one personal account per user. However, users can create virtual wallets or savings goals within the account for better money separation.

How long does it take to verify an account on coyyn.com?

Account verification usually takes 24 to 48 hours after submitting your ID and necessary documents. The process is smooth, and users are notified once approval is complete.

Conclusion:

Coyyn.com banking is reshaping the way we manage money online with its sleek features, smart tools, and user-first approach. Whether you’re a freelancer, a saver, or just want better control over your finances, Coyyn makes digital banking simple and secure. Its growing reputation and helpful team make it a standout option. Explore its tools, test its services, and see how it fits your financial lifestyle. Now might be the perfect time to give Coyyn a try!